/odishatv/media/post_attachments/uploadimage/library/16_9/16_9_0/recent_photo_1740246268.webp)

CM Mohan Majhi

In a big announcement for the Self Help Groups (SHGs) in the State, the Odisha government on Saturday announced to refund the interest collected on loans taken by the groups.

The announcement was made by Odisha CM Mohan Majhi on his X handle.

As per the post, interest on loans up to Rs 10 lakh taken by the SHGs will be returned to the concerned groups.

This measure is set to be implemented in the financial year 2024-25, highlighting the government’s commitment to empowering communities at the grassroots level.

Interest relief

According to the announcement by CM Majhi, the government will forgo Rs 300 crore in interest for more than three lakh SHGs. This initiative seeks to alleviate the financial pressure on these groups, enabling them to contribute more effectively to local economies and support sustainable community development.

Must Read: Odisha women SHGs receive Rs 9L loan notice 7 years after closing bank account; complaint lodged

The decision marks a critical step in enhancing the financial autonomy of SHGs, which play a pivotal role in rural development across Odisha. By providing such financial relief, the government aims to facilitate the expansion of SHGs’ ventures, fostering economic growth and community prosperity.

An earlier complaint by SHGs in Dhenkanal

Earlier in December, several women belonging to three SHGs from Gangijodi village under Tumusingha Police Station in Dhenkanal district had filed a police complaint alleging that they received a loan notice for Rs 9 lakh from their bank despite closing their accounts seven years ago.

As per the allegations, the three SHGs were formed in 2015, and the women had opened accounts in the local branch of the Bank of Baroda. These accounts were reportedly closed in 2017.

However, the women claimed that loans were issued against these accounts in 2019, and notices for the same were sent out to them recently by the bank which stated that a total loan of Rs 9 lakh (Rs 3 lakh against each account) has been issued.

Asteroid may strike Odisha in 2032! NASA warns of potential impact

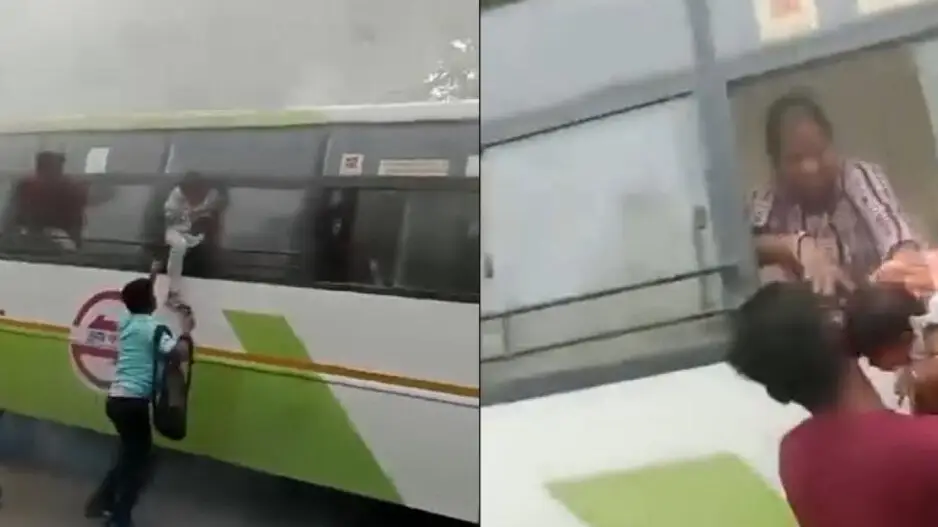

Mo Bus catches fire in Cuttack, passengers evacuated through windows as door jams

Nepalese students are Odisha’s children, will study in full dignity: CM Mohan Majhi

‘Wedding Odisha’ policy soon to promote tourism: Dy CM

/odishatv/media/agency_attachments/2025/07/18/2025-07-18t114635091z-640x480-otv-eng-sukant-rout-1-2025-07-18-17-16-35.png)

/odishatv/media/media_files/2025/09/22/advertise-with-us-2025-09-22-12-54-26.jpeg)