/odishatv/media/post_attachments/uploadimage/library/16_9/16_9_0/recent_photo_1727766826.webp)

Fed up with long queues for cash deposits in banks? Know how UPI-ICD makes it hassle-free

Many people struggle to deposit money at banks due to long lines, server issues, and other challenges like holidays.

However, the NPCI has introduced a solution called UPI-ICD, which makes deposits easier.

With UPI-ICD, you no longer need to stand in long lines at the bank. You can deposit cash into your account or someone else's account without using a debit card.

UPI-ICD is an interoperable cash deposit service that allows customers of participating banks to deposit cash at any bank’s cash recycler or deposit machine enabled for UPI-ICD.

Here’s how it works:

Find a UPI-ICD Enabled ATM: Locate an ATM in your area that supports UPI-ICD.

Select UPI Cash Deposit: Once there, choose the option for UPI cash deposit. A QR code will appear on the screen.

Scan QR Code: Use your UPI app on your smartphone to scan the QR code.

Choose Your Deposit Option: You will see two options: one for depositing into your own account and another for depositing into someone else's account. Select the appropriate option.

Enter Beneficiary Details: If you are depositing for someone else, enter their UPI number (mobile number), Virtual Payment Address (VPA), or account number with IFSC code.

Confirm the Deposit: After filling in the details, enter your UPI PIN. The cash slot will open, and you can insert your cash. Confirm the deposit, and the money will be sent to the beneficiary's account.

Please note that the current transaction limit is less than Rs 50,000 per transaction, and the limits may vary from bank to bank.

India set to host its 1st World Telecommunication Standardisation Assembly in October

WhatsApp users can soon manage notification badges and add interactive polls to status

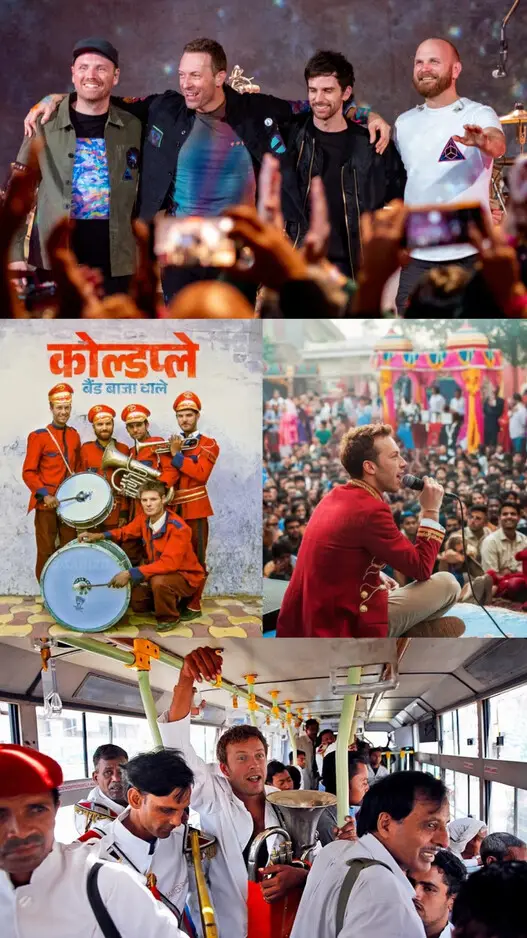

AI Transforms Coldplay Into Vibrant Indian Brass Band Scene

Wild Animals Transformed Into Boxing Champions; Check AI Pics

/odishatv/media/agency_attachments/2025/07/18/2025-07-18t114635091z-640x480-otv-eng-sukant-rout-1-2025-07-18-17-16-35.png)

/odishatv/media/media_files/2025/09/22/advertise-with-us-2025-09-22-12-54-26.jpeg)