/odishatv/media/post_attachments/uploadimage/library/16_9/16_9_0/IMAGE_1643452522.jpg)

Union Budget 2025: What got cheaper and what's costlier; check full list

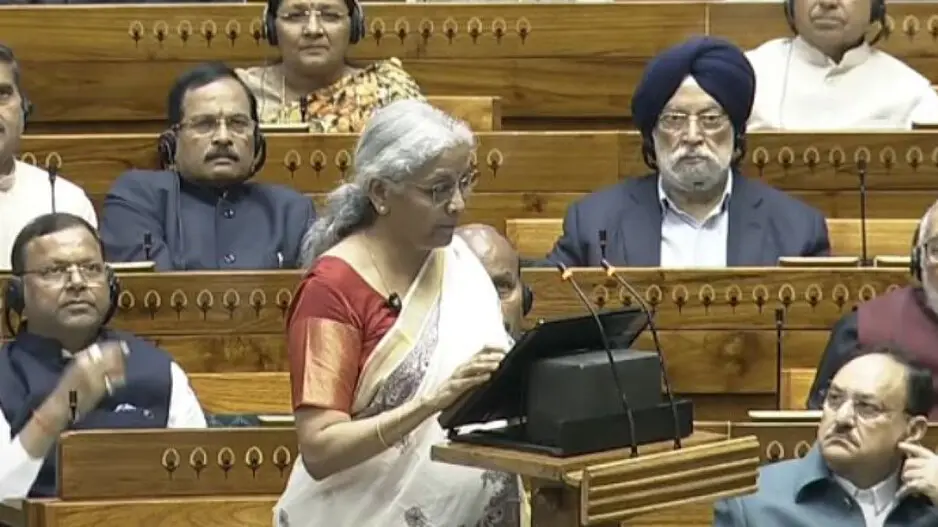

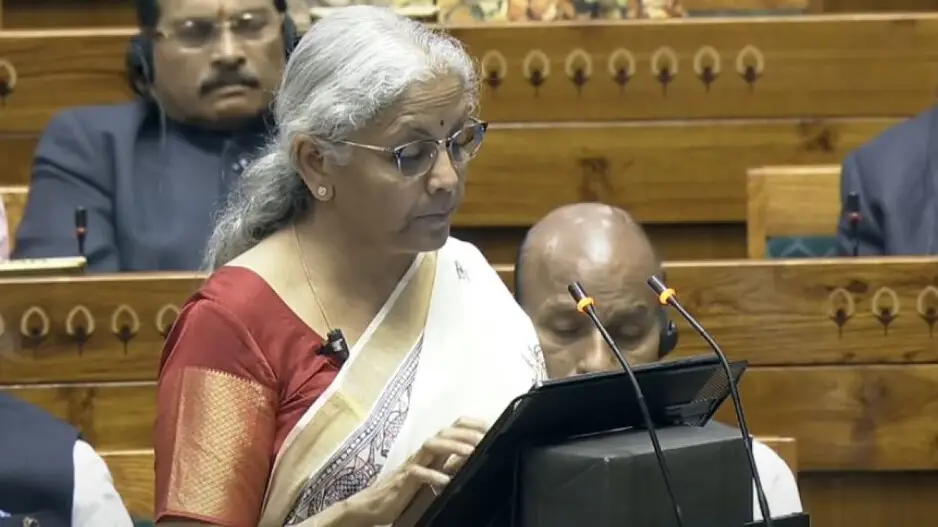

Finance Minister Nirmala Sitharaman introduced massive reforms to the new income tax regime in the Union Budget 2025. In a major boost for the middle class, the FM announced tax exemption for salaried people earning up to Rs 12 lakh.

Furthermore, various sectors saw changes in customs duties, thereby reducing prices. So, let’s take a look at things that got cheaper and things that got expensive after the proposed exemptions.

Things that got cheaper:

1. 36 cancer and rare disease drugs. The budget proposes to exempt 36 drugs used in cancer treatment and for rare diseases.

2. 37 different medicines have also been exempt from customs duty, bringing major relief to the healthcare sector.

3. Cobalt products,

4. LEDs

5. Zinc

6. Lithium-ion battery scrap

7. 12 minerals essential for manufacturing industries like electronics and battery production

8. Shipbuilding raw materials are exempted from customs duty for the next 10 years.

9. Handicraft exports

10. Leather products like wet blue leather

11. Fish pasteurii

12. The duty on ethernet switches carrier-grade has been reduced from 20 per cent to 10 per cent.

13. Motorcycles with an engine capacity not exceeding 1600 CC will have now Basic Customs Duty of 40 per cent instead of the current 50 per cent.

14. Bikes with engine capacity of 1600 CC and above will have reduced Basic Customs Duty of 30 per cent from 50 per cent.

15. Export duty on crust leather (hides and skins) reduced from 20 per cent to zero per cent.

Things that got expensive:

While many essential items saw an exemption in customs duties some goods are set to become costlier, particularly in the tech and manufacturing sectors.

1. Interactive flat-panel displays

2. Provisional assessment time limit

3. Technological products

4. Rationalization of tariff

5. Social Welfare surcharge

6. Basic Customs Duty on knitted fabrics covered under specified tariff items will increase from 10/20 per cent to 20 or ₹115 per kg, whichever is higher.

/odishatv/media/agency_attachments/2025/07/18/2025-07-18t114635091z-640x480-otv-eng-sukant-rout-1-2025-07-18-17-16-35.png)

/odishatv/media/media_files/2025/09/22/advertise-with-us-2025-09-22-12-54-26.jpeg)